Is the US Consumer in the Endgame?

Is the US economy about to slow down?

Households’ spending on goods, services and non financial assets were approximately $662 billion more than cash inflows in 2005, a record 7.3% of disposable income.

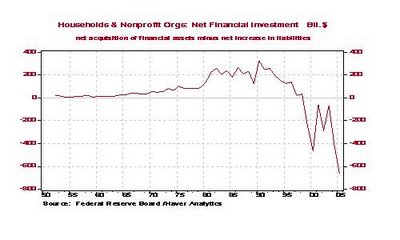

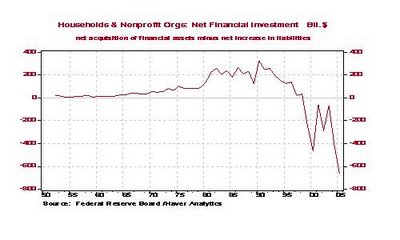

Chart 1 shows net financial investment, defined as households’ net acquisition of financial assets (stocks, bonds, deposits, etc.) minus the net increase in their liabilities (primarily, their borrowing).

Chart 2 shows that households are now running a larger cash deficit than the federal, state and municipal government deficits combined.

In Chart 5, households’ debt is rising at a faster pace than the market value of their assets, hence a record leverage ratio of 18.6% in 2005.

According to David Rosenberg at Merrill Lynch, approximately $2.5 trillion of household debt, or 21% of outstanding household debt will reprice (up) in 2006.

With thanks to Paul Kasriel of Northern Trust

Households’ spending on goods, services and non financial assets were approximately $662 billion more than cash inflows in 2005, a record 7.3% of disposable income.

Chart 1 shows net financial investment, defined as households’ net acquisition of financial assets (stocks, bonds, deposits, etc.) minus the net increase in their liabilities (primarily, their borrowing).

Chart 2 shows that households are now running a larger cash deficit than the federal, state and municipal government deficits combined.

Chart 2

Leverage in the US housing market remains at elevated levels despite rising home values, as shown in Chart 3

Chart 4 shows that households are not doing a very good job of diversifying, as households’ net acquisition of financial assets as a percent of their disposable personal income was 5.7% in 2005 - far below the 1952 through 2005 median value of 10.7%.

In Chart 5, households’ debt is rising at a faster pace than the market value of their assets, hence a record leverage ratio of 18.6% in 2005.

According to David Rosenberg at Merrill Lynch, approximately $2.5 trillion of household debt, or 21% of outstanding household debt will reprice (up) in 2006.

So small wonder eurodollars, having been nervous about the prospect of 5.5% rates by the end of '06, have returned to 5% expected, with the pssibility of cuts mooted for early 2007. Sell those spreads!

With thanks to Paul Kasriel of Northern Trust

2 Comments:

I have been following a site now for almost 2 years and I have found it to be both reliable and profitable. They post daily and their stock trades have been beating

the indexes easily.

Take a look at Wallstreetwinnersonline.com

RickJ

I have been following a site now for almost 2 years and I have found it to be both reliable and profitable. They post daily and their stock trades have been beating

the indexes easily.

Take a look at Wallstreetwinnersonline.com

RickJ

Post a Comment

<< Home